Content

Knowing your figures are correct, and as they should be is vital. Therefore, using a tried and tested accounting software brand is often the way to go for many. This route also ensures your software is reasonably future proof and is adaptable as requirements and legislation changes. Our expert reviewers spend hours testing and comparing products and services so you can choose the best for you. For small businesses, you’ll generally find that dedicated accounting platforms will be more comprehensive. Sign up for your free trial today to grow your business and manage your accounting the easy way.

- You can pay electronically or via check with the integrations, as well as make batch payments, search records and set payment approvals.

- Our online accounting for small business uses breakthrough machine learning technology to save you clicks and precious time.

- While most accounting software is easy to use, a general understanding of accounting principles is needed to ensure that financial reports are prepared correctly.

- FreshBooks is an online accounting software application that works well for sole proprietors and freelancers.

- This software is used to file tax returns in a format suitable with the Internal Revenue Service.

Sage 50cloud Accounting is a powerful piece of software, so why didn’t it receive a higher rating? A dated interface, lack of mobile access, and the requirement to install the software locally keep it from receiving a higher score. Online accounting software can help you make smarter and better-informed plans for an uncertain future by organizing and automating your daily financial tasks. Every year, we test and rate the top web-based accounting services. Some are better for sole proprietors, freelancers, and companies with only one or two employees.

QuickBooks Online

Sage Accounting allows you to automatically send and track invoices, and send customized quotes and estimates to your clients. The multiple approval model and two-factor authentication security feature provide security for all transactions. Every transaction is recorded with a detailed list of actions performed, including the users, date of access and transaction, and manual notes.

What is the best accounting software for small business?

MarginEdge: MarginEdge is the best accounting software for restaurants because it offers a suite of features designed specifically for food service businesses. With MarginEdge, you can automatically import sales data and track your margins in real time by integrating with popular point-of-sale (POS) systems.

Zoho Books: Zoho Books offers the essential features that you need to manage your finances, such as issuing invoices, reconciling accounts, tracking expenses and generating reports. It also provides additional advanced features including project accounting and time tracking if you need them too.

FreshBooks: If you own a small business and don’t have an accounting background, FreshBooks is the software for you. With FreshBooks, you can easily create and send invoices, track expenses, manage projects and clients, and view reports.

Our free small business invoice template gets you paid quickly and easily. Become a Partner and discover a range of cloud solutions that can transform your customer’s businesses and yours. Our flexible HR and payroll software helps you deliver high-quality salary output on time, every time. It is available for download on Windows, Mac OS X and Linux. The database format is universal across all operating systems which means an accounting file created on Windows can be easily transferred to Mac OS X or Linux if the need arises. You can use the program for as long as you like, use all the features and enter as much data as required.

Expenses

AvidXchange offers superior features such as paperless invoicing, PO automation, and B2B payment processing. Cloud accounting software has transformed financial and accounting management by driving efficiency. Accounting reports can now be generated instantly from any device, invoicing and expense management are automated, and even your accountants can access and check your books anytime. AccountEdge Pro offers solid invoicing capability, along with excellent time and billing functionality that can track both billable and non-billable hours.

What is the simplest accounting software?

The simplest accounting software is Neat. It’s easy to use and perfect for self-employed entrepreneurs who need an affordable accounting solution.

Melio is very easy to use, offering one of our favorite user experiences. Melio lets you enter a vendor’s information manually, upload a file with that date or snap a photo of an invoice. You can invite both internal users and accountants to use the software and then assign roles and permissions so you know who is accessing your information and what they are doing with it.

Your business niche

These tasks are both Accounting Software-consuming and prone to human error. Automation can provide enormous time savings for finance departments totaling thousands of hours annually, which is another reason to consider implementing accounting software. If you generate a lot of invoices to send to clients and customers, we recommend that you find a comprehensive accounting application with invoice-generating features. Freelancers should consider using accounting software that can generate invoices.

- Small business accounting software can generate them, but you may need an accounting professional to analyze them to tell you in concrete terms what they mean for your company.

- To process payment from a customer, Wave charges 2.9% plus 60¢ per transaction for Visa, Mastercard, and Discover, and 3.4% plus 60¢ per transaction for American Express.

- However, if you want to exploit the rest of the power tools you’ll need to pay for them.

- To further examine the platform for yourself, it offers a free trial that you can sign up for.

Lack of user control is the effect of keeping data in the cloud, as opposed to one’s own local host, and increases user’s level of unpredictability. Legislative complexity impacts cloud computing in where the data is being stored and the laws that data in that location, or locations, must follow. While cloud computing and traditional IT environments may pose differing privacy issues, the security controls are generally similar.

Find a plan that’s right for you

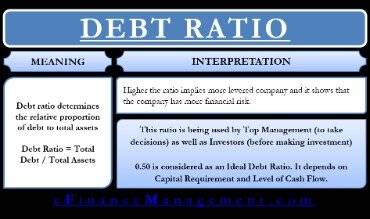

Make sure your program includes a general ledger function and checkbook reconciliation. Using accounting software can save your company time and prevent errors. There are several accounting software vendors catering to various aspects of the market.

- Most accounting applications have a dashboard that gives you a real-time look at your most important metrics.

- For $55 per month ($27.50 per month for your first three months), get the Essentials plan and have up to three users, manage and pay bills and track time.

- The Accounts Payable Aging report breaks down what you owe vendors and when you owe it.

- Your cost can also vary depending on the size of your business.

Last, look for software solutions that offer greater advantages by connecting to other business applications you already use, such as your POS system, CRM system or email marketing software. If you’re looking for an effective, free accounting software, check out Wave Financial. It offers many important, high-quality accounting features at no cost to you.

Procurement Management

We offer a variety of accounting reports that you can use to get a snapshot of your financial health, view key details, and more. The P&L statement measures the financial health of your business by showing income and expense details. I am currently successfully running payroll and using the accounting program.

The Best Accounting Software for Small Businesses in 2023 – PCMag Middle East

The Best Accounting Software for Small Businesses in 2023.

Posted: Wed, 04 Jan 2023 08:00:00 GMT [source]

Accounting software can help small businesses with a multitude of operations, including managing their expenses and tackling tax season. Unit4’s software-as-a-service platform delivers intelligent enterprise applications on a foundation for your organization to innovate and deliver great experiences. Your people get the flexibility and freedom to have what they need, how, when and where they need it. Help your business and finance people work together more efficiently and improve invoice accuracy to reduce customer disputes and receive payments faster. Our online accounting for small business uses breakthrough machine learning technology to save you clicks and precious time. With Accounting Premium, you can send recurring invoices to your customers on your desired schedule at no additional charge.